Energy and sustainability projects are gaining momentum amongst corporate leaders, but managers still need a solid rationale to get financial approval. In this article, we tackle this matter and explain, with the help of our manufacturer partners, the options available and explain how you can gain capex-free funding for energy saving projects for your organisation.

Successful projects can improve productivity by using fewer resources, producing less waste and improve profitability. Despite these benefits, energy managers may wonder why it is so hard to get approval and funding (CapEx)?

When funding new projects or investments to improve their business, companies use capital expenditure (CapEx). Examples of CapEx include repairing a roof, purchasing a piece of equipment, or building a new factory or warehouse. This means capitalising costs by holding them on the balance sheet instead of expensed on the annual income statement.

However, companies often perceive CapEx as a hurdle to accomplishing energy and sustainability projects, but this assumption may be misleading. A key variable to the success of all corporate energy and sustainability initiatives is building an accurate business case.

Is funding a false barrier?

In recent Schneider Electric research, more than 300 US. industry professionals shared their experiences about finding funding for energy and sustainability projects. The results suggest that developing a solid business case may be more important than the immediate availability of capital. Moreover, there is widespread confusion about the barriers for project approvals, with past successes being a key outcome indicator, Schneider questions whether funding is a false barrier to energy projects.

Teams that have had trouble getting projects approved in the past may want to focus more on the business case. If the business case is solid, it should be easier to locate budget.

According to one food manufacturer surveyed, “Being able to show investment plans and their payback had a larger impact on leadership decision making than overwhelming them with lots of data about kilowatt-hours and carbon output.”

Problems Gaining Project Approval

-

- 1 Energy and sustainability projects may have trouble competing with other projects that yield more traditional business results.

2 Individual project sponsors may have less experience securing funding when compared to others in the organisation.

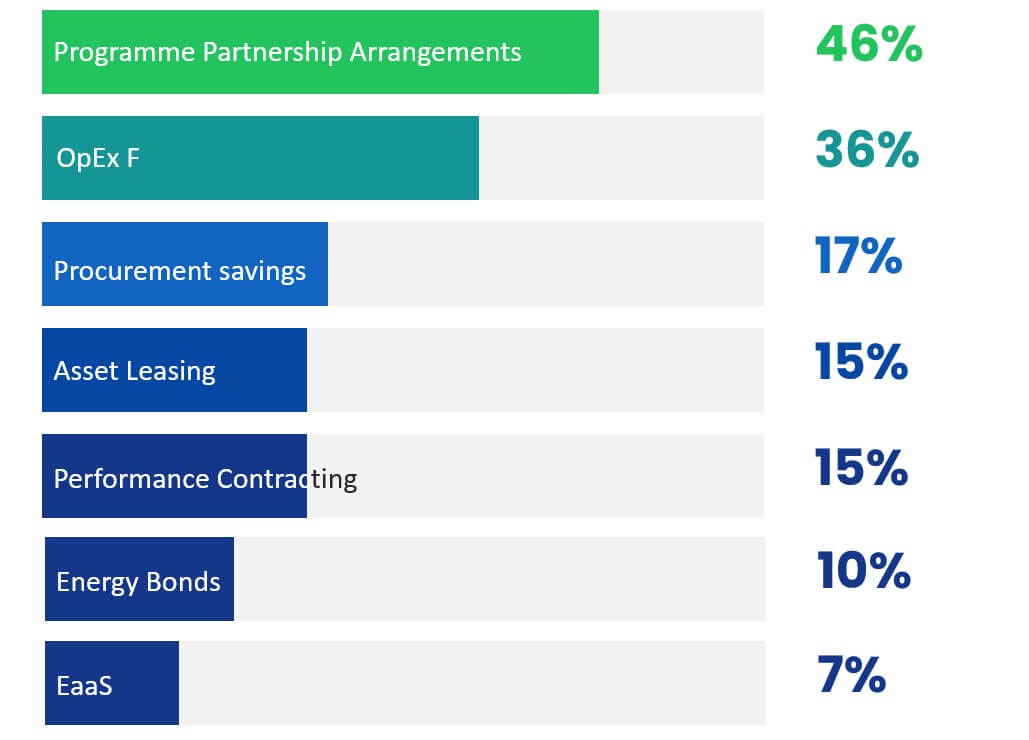

The research further indicates that businesses with a higher success rate of projects have a more diverse funding mix. For energy and sustainability projects with a strong business case, there are a variety of funding models available. These may reduce the perceived capital intensity of the projects and improve the chances of project approval. The research also identified a spread of funding sources from a wide range of industries. In fact, each market segment has used at least five of the funding mechanisms.

Alternatives to CapEx funding for energy-saving projects:

For example, Energy-as-a-Service (EaaS), is an approach allowing firms to outsource control of its entire energy portfolio. The finance industry and commercial property firms tend to adopt this approach. Regardless of the funding mechanism, the importance of building a strong business case will always remain. Although conducted in the USA, most of these funding options are available in the UK.

Whether the motivation is from financial goals, sustainability targets, or resilience concerns, the solution must align with the organisation’s priorities. Selecting a funding model that works with those priorities is key to gaining buy-in.